does texas have an inheritance tax 2019

Up to 25 cash back parents siblings and other close relatives can inherit 40000 tax-free and pay just 1 of the market value of inherited property over that amount. The state repealed the inheritance tax beginning on 9115.

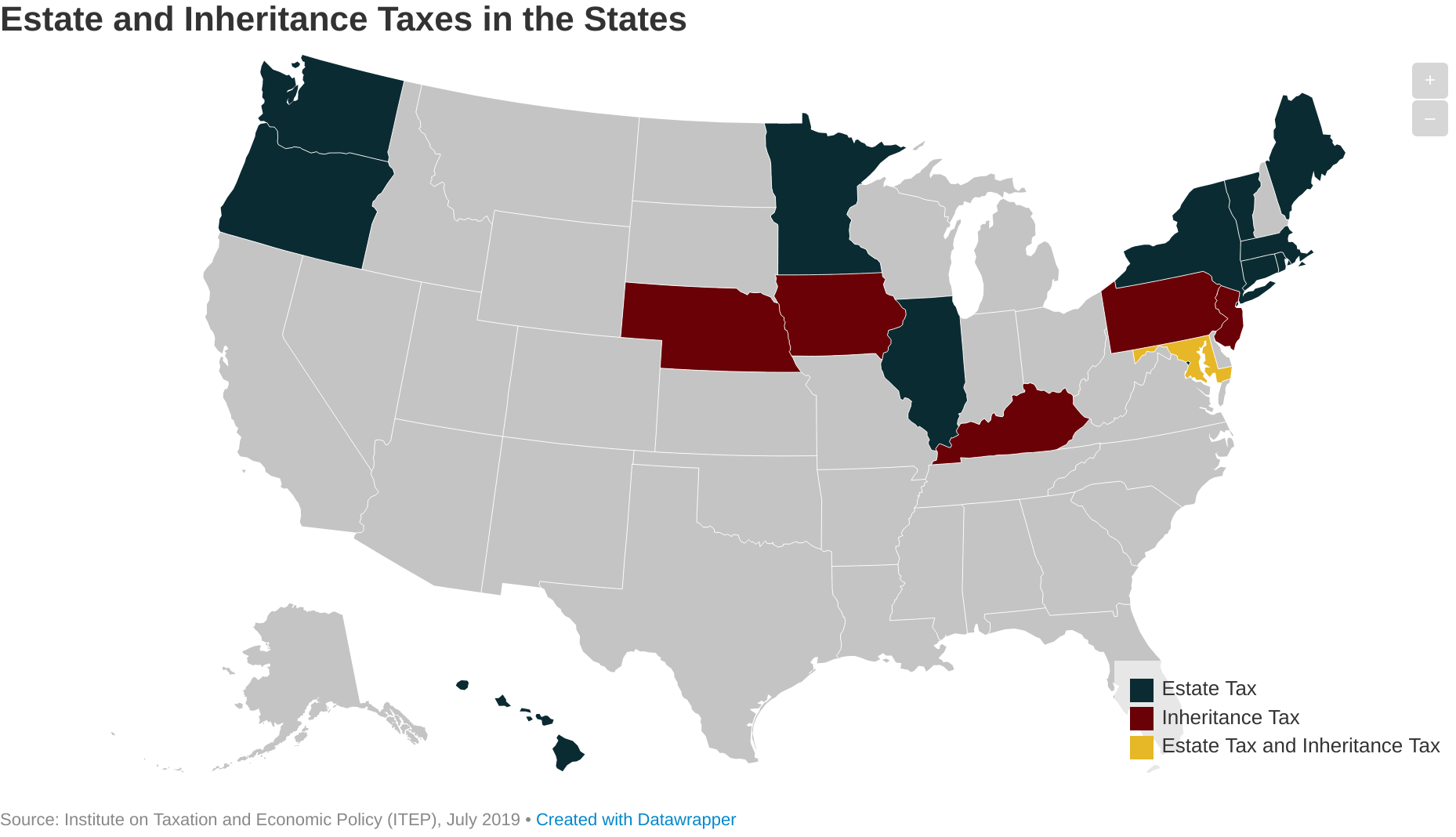

Here S Which States Collect Zero Estate Or Inheritance Taxes

No estate tax or inheritance tax Vermont.

. That said you will likely have to file some taxes on behalf of the deceased including. Gift Taxes In Texas. T he short answer to the question is no.

The state repealed the inheritance tax beginning on Sept. All six states exempt spouses and some fully or partially exempt immediate relatives. However other states inheritance taxes may apply to you if a loved one who lives in those states gives you money so make sure to check that states laws.

The top inheritance tax rate in any state is 18. Each are due by the tax day of the year following the individuals death. For example in Pennsylvania there is a tax that applies to out-of-state inheritors.

Non-relatives pay 18 on amounts over 10000. As of 2019 only twelve states collect an inheritance tax. Some beneficiaries will have to pay some taxes on behalf of the generous dead person.

In 2011 estates are exempt from paying taxes on the first 5 million in assets. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. The top estate tax rate is 16 percent exemption threshold.

Federal estatetrust income tax. Theres no personal property tax except on property used for business purposes. Even though no state inheritance taxes are imposed some estates are subject to federal estate taxes.

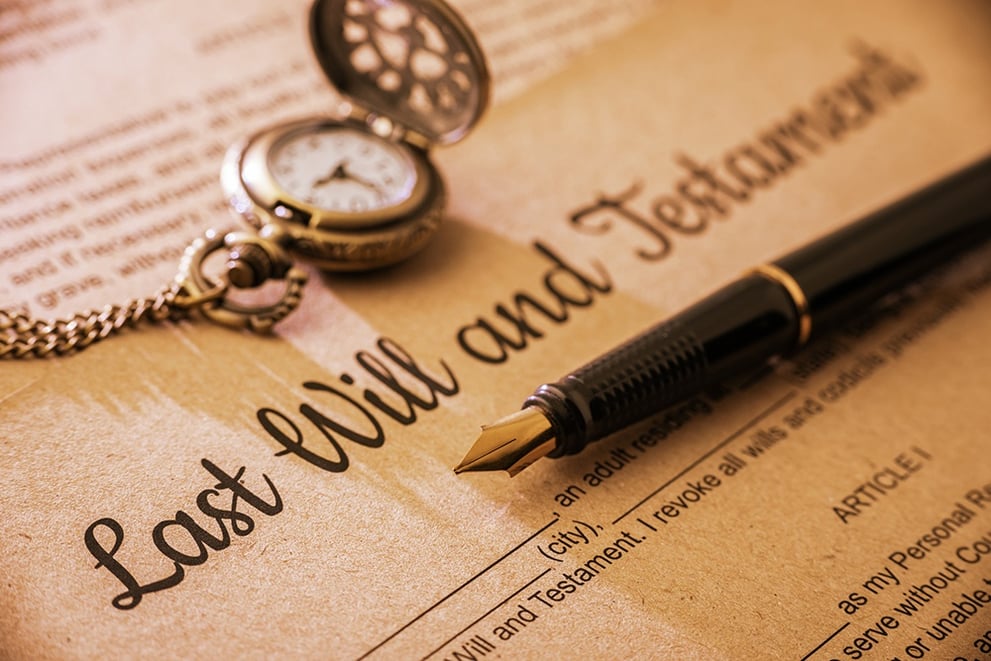

Has the highest exemption level at 568 million. In fact Texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death. Texas is one of a handful of states that does not have an inheritance tax.

So a married couple gets two step-ups one at the time of the first spouses death and another at the time of the second spouses death. The federal government of the United States does have an estate tax. However this is only levied against estates worth more than 117 million.

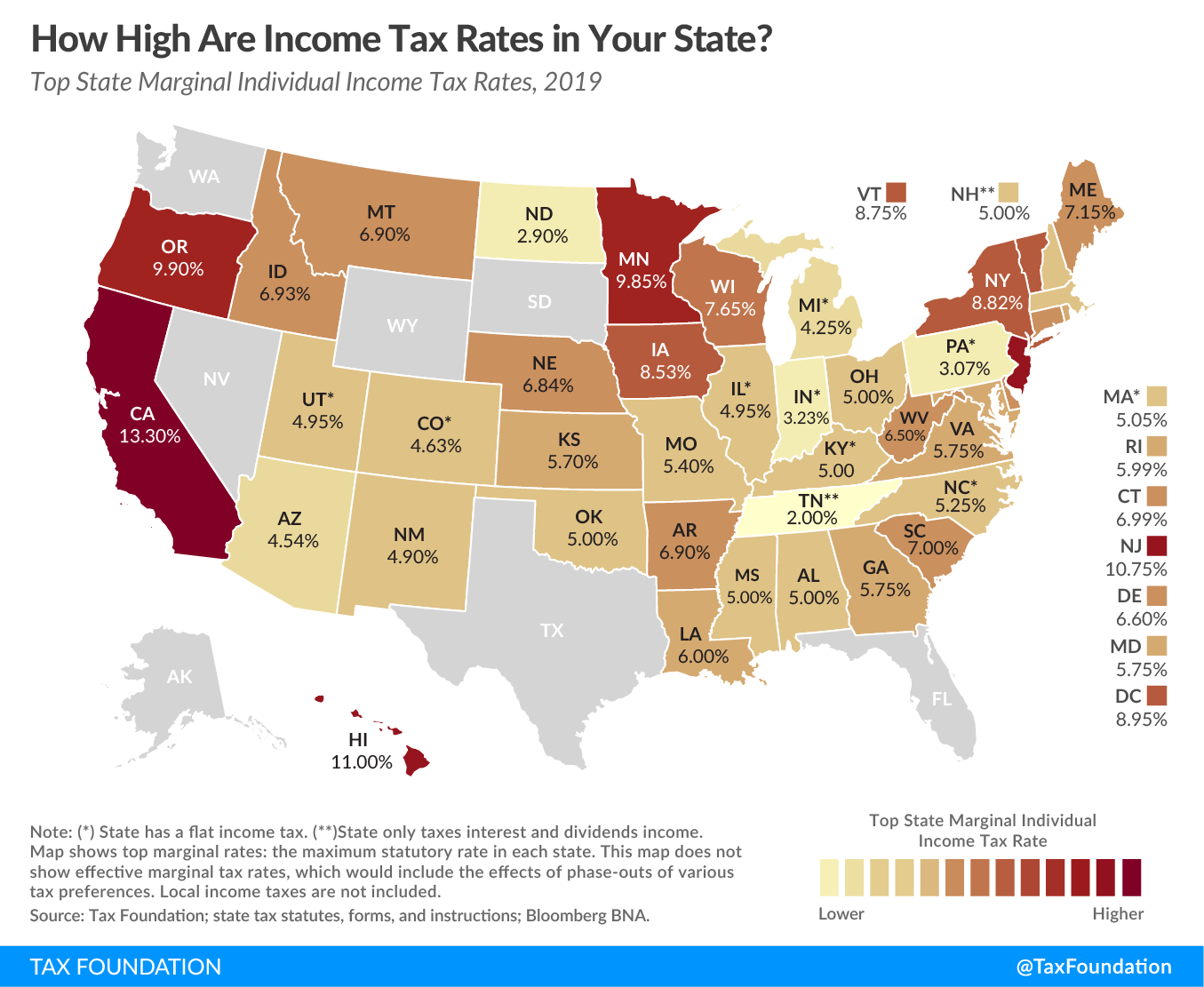

But there is a federal gift tax that people in Texas have to pay. For instance theyll have to pay the final federal and state income taxes and any federal estate income taxes as well as any federal estate taxes. The sales tax is 625 at the state level and local taxes can be added on.

The rates of tax in Minnesota on amounts over 2700000 are between 13 16. Texas has no inheritance tax so any money you receive as a beneficiary is not charged state tax income tax property tax or capital gains tax. There is a 40 percent federal tax however on.

The good news is that Texas doesnt impose an estate or inheritance tax. Someone will likely have to file some taxes on your behalf after your death though including the following. Prior to september 15 2015 the tax was tied to the federal state death tax credit.

Does Texas Have An Inheritance Tax 2019. The state of Texas is not one of these states. Finding Information About Taxes On Interest An initial gift of money or property is tax-free but if.

Tax is tied to federal state death tax credit. Note that if you leave everything to your spouse there is no estate. No estate tax or inheritance tax Utah.

Its inheritance tax was repealed in 2015. Federal estatetrust income tax. Additionally the state no longer has an inheritance tax which means that if your loved ones inherit from you they will not be taxed on the assets they receive.

However in Texas there is no such thing as an inheritance tax or a gift tax. Maryland imposes the lowest top rate at 10 percent. However localities can levy sales taxes which can reach 75.

Does Texas Recognize Domestic Partnership In 2019. This is because the amount is taxed on the individuals final tax return. You can give a gift of up to 15000 to a.

Before 1995 Texas collected a separate inheritance tax called a pick-up tax. Texas does not have a state estate tax or inheritance tax. The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received.

Minnesota has an estate tax for any assets owned over 2700000 in 2019. The tax did not increase the total amount of estate tax paid upon death. So if you live in washington and leave money to someone who resides in one of these states they will not owe inheritance tax.

Final federal and state income tax returns. However if a loved one gifts you something elsewhere in the country you may need to pay that states inheritance tax. No Texas does not have an estate tax for the time being.

Of the six states with inheritance taxes Nebraska has the highest top rate at 18 percent. These states have an inheritance tax. Texas also imposes a cigarette tax a gas tax and a hotel tax.

Final individual federal and state income tax returns. Estates over that amount must pay estate tax on the amount not covered by the exemption and how big the estate is determines what. The state of Texas does not have any inheritance of estate taxes.

If you have a loved one who dies in Pennsylvania and leaves you money you may owe taxes to. Higher rates are found in locations that lack a property tax. Texas has no income tax and it doesnt tax estates either.

The federal government eliminated inheritance taxes and instituted an estate tax policy that most states including Texas follow. Alaska is one of five states with no state sales tax. There is also no inheritance tax in Texas.

Massachusetts has the lowest exemption level at 1 million and DC. The state of Texas does not have an inheritance tax. There is a 40 percent federal tax however on estates over 534 million in value.

More distant relatives pay 13 for amounts over 15000 and. While most states in the United States have an inheritance tax Texas doesnt. If you die with a gross estate under 114 million in 2019 no estate tax is due.

So only very large estates would ever need to worry about this tax becoming an issue. Therefore if you inherit possessions property to sell or keep or money from a loved one in Texas you most likely wont need to pay any tax. There are no inheritance or estate taxes in Texas.

Rather a portion of the federal estate tax equal to the allowable state death tax credit on the federal estate tax return was deducted from amount due to the federal government and. This means that if you have 3000000 when you die you will get taxed on the 300000 over the 2700000 exemption.

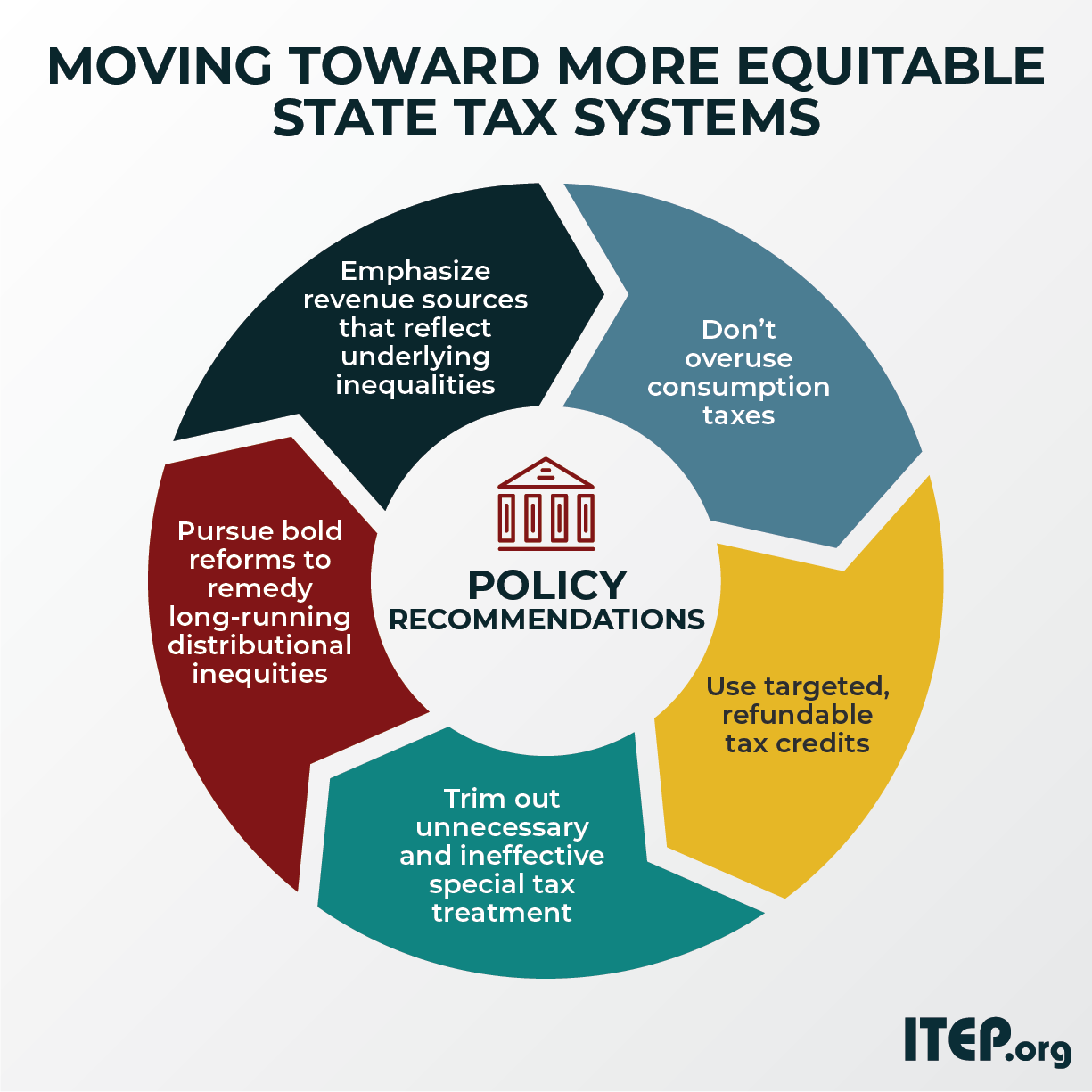

Moving Toward More Equitable State Tax Systems Itep

How Do State And Local Sales Taxes Work Tax Policy Center

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Are Your Clients Subject To Massive Estate Taxes Without Knowing It Everplans

States With Highest And Lowest Sales Tax Rates

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Us State Tax Planning Gfm Asset Management

Texas Estate Tax Everything You Need To Know Smartasset

Estate Tax Can Pay Off For States Even If The Superrich Flee The New York Times

Texas Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi

Texas Inheritance And Estate Taxes Ibekwe Law

The Best Way To Leave Land To Your Family Members

Estate Tax Can Pay Off For States Even If The Superrich Flee The New York Times