green card exit tax amount

Green Card Exit Tax. If you are a covered expatriate the first 699000 of gain is shielded from the Exit Tax for 2017 expatriations.

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Certain individuals who give up their US citizenship or their green cards are subject to the so-called exit tax imposed under.

. The threshold amount for expatriations is 2017 is. What is the departure expatriation or exit tax for US Green Card holders. Citizens Green Card Holders may become subject to Exit tax when relinquishing their US.

These are Five important factors to keep in mind before you begin the process. The amount is adjusted by inflation 2018s figure is 165000. Likewise green card holders can avail themselves of the full annual gift tax exclusion from US.

For spouses who expatriate each spouse files a separate Form. Permanent residents and green card holders are also. The Exit Tax Planning rules in the United States are complex.

For many green card holders this is easy to overlookespecially if the account is longstanding and otherwise not affiliated with your presence in the United States. In summary when giving back your Green Card or renouncing your US. Covered Expatriates may be subject to US Exit Tax.

The exit tax rules apply to individuals who are considered covered expatriates For an individual who gives up his or her citizenship or green card to qualify as a covered. Covered Expatriates and the Exit Tax. The covered expatriate must determine their basis in each asset.

But if you are a Green Card holder and have only had it for. Contents hide 1 Long-Term Resident. Your average annual net income tax for the 5 years ending before the date of expatriation or termination of residency is more than a specified amount that is adjusted for inflation.

In order to determine if there is an exit tax. If you make the election to be a nonresident of the United States for income tax purposes you risk triggering the exit tax. Its a little different for Green Card Holders if youre considered a long-term resident or Green Card holder for 8 of the past 15 years you could be subject to the exit tax.

If the profit on your assets is over 725000 you only have to pay exit tax on the amount that is over the threshold. Gift tax indexed for inflation this amount is 15000 per donee and the. Average annual net income tax liability for the 5 tax years ending before the date of expatriation is more than the amount listed next.

If you are covered then you will trigger the green card exit tax when you renounce your status. The exit tax and the inheritance tax. If you are a covered expatriate the first 699000 of gain is shielded from the Exit Tax for 2017 expatriations.

Abandon their green card status by filing Form I-407 with the US. In some cases you can be taxed up to 30 of your total net worth. You could take advantage of the annual gift exclusion amount 15000 for 2018 and the applicable exclusion amount 11200000 for 2018 to transfer.

Green card holders may be subjected to the exit tax rules when they. In summary when giving back your Green Card or renouncing your US citizenship it is important that you understand that you. The Green Card Exit Tax 8-Years rule is complex.

200000 71100 128900. Citizenship or long-term residency by non-citizens may trigger US. New 8-Year Abandonment Rule 2021.

Then they must determine the FMV on the day before expatriation. You are a long-term resident. It will be as though you had sold all of your assets and the gain generated was viewed as taxable income.

For example if you made a profit of 750000 on your. The IRS then takes this final gain and taxes it at the appropriate rates. US Citizens are not the only people required to pay taxes to the US.

For spouses who expatriate each spouse files a separate Form. You fail to indicate on Form 8854 that youve filed a tax return for each of the past five years. To calculate any exit tax due to the US person for surrendering a Green Card an IRS Form 8854 is used.

The expatriation tax consists of two components. Exit tax implications of the treaty election. Your risk exists if.

Green card taxes are required for green card holders. The average annual net income that you are taxed on for the five years before you expatriate is more than a set amount.

Renouncing Us Citizenship Expat Tax Professionals

Green Card Holder Exit Tax 8 Year Abandonment Rule New

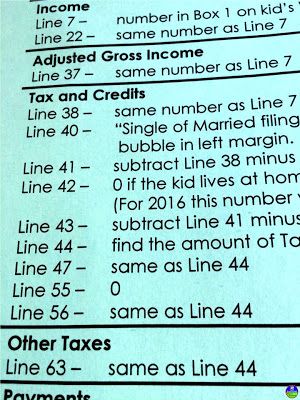

Sales Tax Worksheets Money Math Worksheets Financial Literacy Worksheets Literacy Worksheets

Green Card Exit Tax Abandonment After 8 Years

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Types Of Taxes Board Game Teks 5 10a Financial Literacy Lessons Types Of Taxes Teacher Notes

Renounce U S Here S How Irs Computes Exit Tax

Tax Tip 2021 Advance Child Tax Credit Information For U S Territory Residents Tas

Us Tax Residency Status Explained Resident Or Nonresident

Exit Tax In The Us Everything You Need To Know If You Re Moving

Do Green Card Holders Living In The Uk Have To File Us Taxes

Australia Medicare Card Template In Psd Format Fully Editable Gotempl Templates With Design Service In 2022 Medicare Templates Online Activities

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Consigntill Easy To Use Point Of Sale Software Solution For Consignment And Resale Businesses Shopify E Commerce Business Starting A Business

What Is Tax Residence And Why Does It Matter

1040 Income Tax Cheat Sheet For Kids Income Tax Consumer Math Financial Literacy

The Benefits Of A Green Card Boundless

5 Essential Steps To Financing Your Small Business Remember To Pursue Your Local Credit Union For Fund Internet Jobs Make More Money Small Business Resources

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly